Introduction to Housing Market Crash

housing market crash If you’ve been following the news, scrolling through social media, or just chatting with friends and family, chances are you’ve heard the phrase “housing market crash” more than once lately. The real estate market has been on a rollercoaster for the past few years, and now there’s a mix of concern, speculation, and flat-out panic about housing market crash what’s next. Some people believe we’re heading straight into another crash like the one in 2008, while others say the market is just correcting itself after an unprecedented surge.

So, what’s really going on? Is a crash inevitable, or are we all just overreacting to a few scary headlines? This article will walk you through the current state of the housing market crash housing market, the signs that point to a potential crash, and what it all means for homeowners, investors, and everyday people just trying to find a decent place to live.

A Quick Look Back: What Happened During the 2008 Housing Crash?

To understand what might be housing market crash coming, it helps to look back at what happened in 2008. That year marked one of the biggest financial disasters in modern history, and the housing market was at the center of it. Back then, the crash was caused by a mix of reckless lending, lack of regulation, and speculative buying. Banks handed out mortgages to people who couldn’t afford them, and when home prices started falling, everything came crashing down.

Entire neighborhoods went into foreclosure. Big-name banks collapsed. Millions of people lost their homes and life savings. It wasn’t just a housing problem—it was a full-blown economic meltdown. Since then, laws have changed, banks have tightened their lending standards, and most people assume we’re better protected from something like that happening again.

But are we?

The Current Situation: Prices, Rates, and Supply-Demand Imbalance

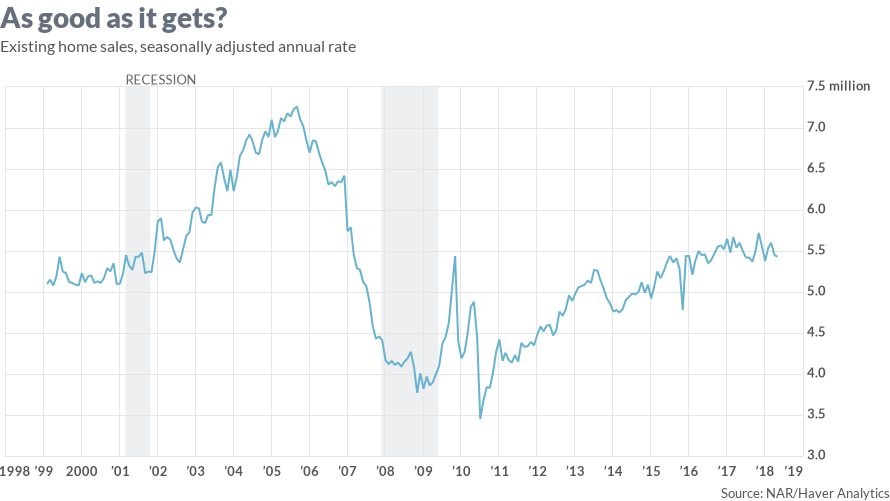

Today’s housing market housing market crash looks quite different from 2008, but that doesn’t mean it’s immune to trouble. In fact, it’s been showing some worrying signs. First off, home prices skyrocketed between 2020 and 2022. Low interest rates and a huge demand for space during the pandemic drove prices through the roof. People were making offers well above asking price, sometimes without even seeing the house in person.

Fast forward to now—interest rates have housing market crash risen sharply in response to inflation, making mortgages way more expensive. That’s priced many buyers out of the market. As a result, demand has cooled off, but prices haven’t dropped dramatically yet. That’s left us with a strange imbalance: fewer buyers, reluctant sellers, and a market that feels frozen.

Then there’s the issue of housing supply. In many areas, there still aren’t enough homes to meet demand, especially affordable ones. Builders slowed down during housing market crash the pandemic and haven’t fully caught up. So while prices may be too high for many buyers, the low inventory keeps them from falling rapidly.

Warning Signs: What Could Trigger a Crash?

Even though we’re not housing market crash seeing a full-blown crash yet, there are definitely warning signs we shouldn’t ignore. One big red flag is the high level of household debt. Many Americans are carrying massive loads of credit card, auto loan, and student debt. If unemployment rises or wages stagnate, paying off those debts—and a mortgage—could become too much for a lot of people.

Another concern is mortgage delinquencies. While we’re not seeing 2008-level numbers, there has been an uptick in people falling behind on their payments. That’s often the first domino to fall in a crash scenario. If foreclosures increase, home values can start dropping quickly, setting off a downward spiral.

Investor behavior is also worth watching. In recent years, a lot of homes were bought by institutional investors—big companies betting on rising rents and property values. If the market turns, they could dump properties fast, flooding the market and dragging prices down with them.

Will It Be Like 2008 Again?

The good news is that most housing market crash experts don’t believe we’re headed for a repeat of the 2008 disaster. The financial system is more stable, lending practices are more responsible, and there’s no glut of overbuilt housing like there was back then. Most homeowners today have fixed-rate mortgages and solid credit profiles.

That said, just because it housing market crash won’t be that bad doesn’t mean it won’t be bad at all. A “slow crash” or extended downturn could still do a lot of damage—especially for younger buyers, renters, and people living paycheck to paycheck. Home values could stagnate or dip slightly, while mortgage costs remain high. That’s not exactly a crisis, but it’s not sustainable either.

We’re also seeing regional differences. Some hot markets like Austin, Boise, and Phoenix are already cooling off, while others like New York and Miami remain strong. The national picture might be stable, but local markets could still crash hard.

What This Means for Homeowners and Buyers

If you already own a housing market crash home, don’t panic—but do pay attention. Now’s a good time to assess your mortgage situation, your income stability, and your long-term plans. If you’re locked into a low-rate mortgage and you’re not planning to move anytime soon, you’re probably fine. But if you’re on an adjustable-rate mortgage or you stretched your budget to buy, it’s worth exploring options.

For buyers, patience is key. Rushing into the market because you’re afraid of “missing out” could backfire. Prices may come down slightly, but higher interest rates can cancel out the savings. The smart move is to keep your finances strong, get pre-approved, and wait for the right deal—not just any deal.

Renters also need to be cautious. As the market shifts, landlords may raise rents to make up for their own higher costs. Keeping an eye on your lease terms, local rent control laws, and alternative housing options can help you stay ahead of the game.

Real Estate Investors: Risky Times Ahead?

Investors who made big gains during housing market crash the housing boom are in a tricky spot. Flipping homes is riskier now, as it’s harder to predict how long a property will sit on the market or whether its value will hold. Long-term investors might fare better, especially those focused on rental income. But rising interest rates, insurance costs, and property taxes can eat into profits quickly.

Some investors are already scaling back, while others are shifting to multi-family properties or markets with more affordable entry points. The key is flexibility—those who adapt will survive, while those who stick to outdated strategies may get burned.

What Should You Do Now?

So, with all this uncertainty, what should regular people actually do about the potential housing market crash? The answer depends on your personal situation, but here are a few general tips:

- Don’t panic – Crashes don’t happen overnight. You’ll have time to react.

- Stay informed – Keep up with local and national trends. Your city’s market may look very different from the headlines.

- Make smart financial choices – Avoid overleveraging, save an emergency fund, and don’t stretch your budget.

- Consult professionals – Whether it’s a realtor, financial advisor, or mortgage expert, getting advice tailored to your situation is always wise.

Conclusion:

The truth is, no one can predict the future with absolute certainty. There are definitely signs that the housing market is cooling—and possibly headed for a downturn—but whether that becomes a crash depends on a lot of moving parts. Inflation, interest rates, employment trends, and even global events can all influence the outcome.

What we can do is prepare. Educate yourself, keep your finances in check, and make informed decisions. Whether you’re a homeowner, a hopeful buyer, or just someone watching from the sidelines, the housing market affects us all. And while the road ahead might be bumpy, knowledge is the best way to ride it out.